Did you know that one of the best gifts you can give your Children/Teenagers is to prepare them to be empowered and responsible with Money? We believe that lessons learnt early in life last for a lifetime.

We at Attique Money Academy welcome you to sign them up this Life changing Money Lessons for Children & Teenagers December Holiday Boot camp (December 2024 edition). The objective is to cultivate positive money habits, skills and attitudes from an early age for a lifetime of financial well-being.

Mission

To raise, equip and empower financially responsible citizens who will build strong Families, Neighborhoods as well as Local and International Communities.

Objectives of the Boot Camp:

- To Nurture positive money habits and attitudes in Teenagers & Children for a lifetime of financial well-being.

- To deliver key foundation knowledge and build capacity in handling money from an early age.

- To prepare children/teens for World realities around Money. This will greatly improve many other aspects of their lives.

- To help Teenagers & Children differentiate between needs and wants hence make wise spending decisions.

Class Schedules & Timings

Classes will be happening in Weekly batches i.e. you can sign them up for a week, two weeks etc. Continuing students will engage in an advanced curriculum while new students will restart the curriculum. Daily Classes will begin from Wednesday November 6th , 2024 followed by weekly intakes (Wednesdays – Fridays) up to Friday December 6th 2024. For efficiency, participants will be divided into age groups as follows:

Evening hours Attendees

- 7-11 Year old – 4.30- 5.30 p.m. (EAT)

- 12-17 year old -6.00 – 7.00 p.m. (EAT)

The Curriculum

The curriculum is well researched and has been tested with different groups of Children and Teenagers in different set ups including Schools, seminars & conferences, schools, holiday programs, Youth Camps and Churches. It has been officially published in Finance Literacy books targeting Children, Teenagers and Young Adults. These books serve as the curriculum for this training. What is more is that there will be homework after every topic. It is intended to be attempted with assistance from the Parents/ Guardians. This is to ensure that the money subject continue flowing right from home, for a lifetime of financial well-being.

| Money Club Online Training Timetable | ||

| Week 1 | ||

| Day | 7-11 years | 12-17 Years |

| Wednesday |

|

|

| Thursday |

|

|

| Friday |

|

|

| Week 2: | ||

| Wednesday |

|

|

| Thursday |

|

|

| Friday |

|

|

| Week 3 | ||

| Wednesday |

|

|

| Thursday |

|

|

| Friday |

|

|

| · Week 4: | ||

| Wednesday |

|

|

| Thursday |

|

|

| Friday |

|

|

| · Week 5: | ||

| Wednesday |

|

|

| Thursday |

|

|

| Friday |

|

|

Training Methodology

This training is so impactful, fun, highly practical and interactive. Children are always called upon to engage in practical activities around money and discussions throughout the training. We also make use of various media to illustrate key points including videos and music. This allows participants to learn more, remember more and apply more! We also undertake simple money making projects within the school/at home wherever applicable to make the money subject more practical.

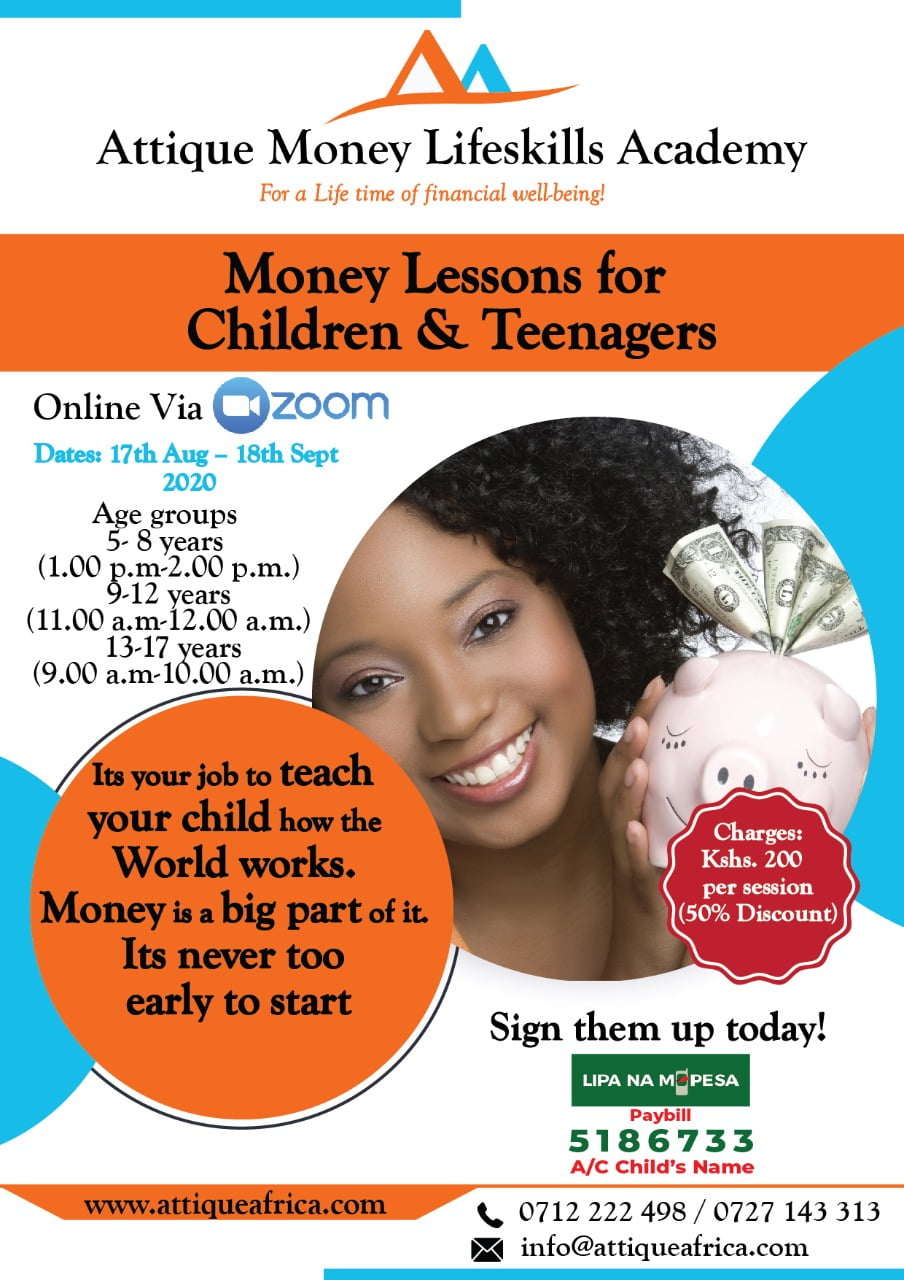

Charges:

The financial investment in this noble undertaking is highly subsidized and a worthy Investment. Charges will be Kshs. 1,500.00 per student per week or Kshs. 7,000.00 for the 5 weeks. Enrollment is open for weekly undertakings i.e. continuing students will engage in an advanced curriculum.

Venue:

Online via Google meet.

For Children/Teenagers online Security reasons, class link will always be sent just shortly before the class.

Booking:

- Pay the fees (Kshs. 1,500.00 per student per week or 7,000.00 for the 5 weeks) through M-pesa Till Number: 9 8 1 9 1 8 3

- Forward the M-pesa Confirmation message to +254 727 143 313 with the Child name and age for confirmation and booking.

- Provide a number where class links will be shared.

- Prepare the participants for the lessons with the right gadgets, Pens & note books

Team Profile

Our team is able, trained and Children Friendly. We have a mandate to help people put order in their money for a lifetime of financial well-being. We are especially passionate about Children, teenagers and young adults. To cultivate positive money habits, skills and attitudes for a lifetime of financial well-being. We believe that lessons learnt early in life lasts for a lifetime. Our team leader is a Money Coach, Trainer & Prolific Author who has officially published Finance Literacy and Entrepreneurship Development Work books which are available for sale and whose titles are as below:

- What is Money? – Money Life skills for Children from 5 years of age

- Needs Versus Wants – Money Life Skills for Children from 9 years of age

- Savings as a Life skills – Money Life skills for Children from 7 years of age

- Is Money a Treasure?- Money Life skills for Children from 9 years of age

- Money Life skills for the 21st Century Teenagers

- Generating my Unique Business Idea- An entrepreneurship support work book.

- Money Nuggets Work Book – Over 52 Weeks of Personalized Money Coaching Mini Classic

- My Personalized Financial Planner- Track how you save, spend and manage your Money to eliminate your Money Leakages!

- Master your Money – The ultimate Personal Finance Planning handbook, guide and Financial Freedom Manual

- Destroy that Debt!- A debt action planning Manual

Conclusion

I trust that you will find our request and recommendations acceptable and look forward to forming a wonderful relationship with you that translates to success for all concerned. Please feel free and welcome to contact us on 0727 143 313/0729 468 251/ [email protected] for more details.

Thank You.